You've heard the stories: traders making thousands while monitoring charts 24/7. But here's what nobody tells you - 87% of successful crypto investors in 2026 aren't full-time traders. They're people like you, balancing spreadsheets at work while building wealth through smart, automated strategies.

With Bitcoin trading at $95,000+ and institutional adoption accelerating through ETF staking approvals, 2026 presents unprecedented opportunities for working professionals to build meaningful crypto wealth - without sacrificing their careers or sanity.

In this comprehensive guide, you'll discover the exact schedule, tools, and strategies that successful part-time investors use to generate $200-600+ monthly passive income while working 9-to-5.

Yes, absolutely. The key is shifting from active trading (which requires 4-8 hours daily) to automated strategies like DCA, staking, and crypto lending. Successful part-time crypto investors spend just 30-60 minutes per day monitoring their portfolio, with deeper research on weekends.

Realistic expectations 2026: 8-25% annual returns through DCA + staking + lending on a diversified portfolio. With $10,000 invested, that's $800-$2,500/year in passive growth - plus potential price appreciation.

What You'll Learn in This Guide

This isn't another generic "buy Bitcoin" article. We've compiled research from January 2026 with current APY rates, platform recommendations, and real-world strategies specifically designed for professionals with limited time.

By the end, you'll know:

- The exact daily schedule successful part-time investors follow

- Which passive income strategies actually work (and which are traps)

- Current staking APY rates for 2026 (updated January)

- How to automate 90% of your crypto management

- Realistic income projections based on your investment level

- Tax implications you can't afford to ignore

📋 What's Covered

Why Most Part-Time Crypto Investors Fail (And How to Avoid It)

The biggest mistake working professionals make isn't choosing the wrong coins - it's choosing the wrong strategy.

Day trading, which requires monitoring charts for hours and making split-second decisions, is fundamentally incompatible with a 9-to-5 schedule. Consider this:

- Professional day traders spend 4-8 hours actively watching markets

- They have multiple monitors, real-time data feeds, and years of experience

- Statistics show 90-95% of day traders lose money - and that's full-time traders

- Trying to compete with them during your lunch break is like bringing a knife to a gunfight

- Day Trading: Requires 4-8 hours daily, 90%+ lose money

- Leverage/Margin Trading: Can be liquidated in minutes while you're in meetings

- Meme Coin Flipping: Requires constant monitoring, insider knowledge

- NFT Trading: Time-intensive research, volatile market

- Crypto Futures: High risk of total loss during volatility spikes

If you don't have 4+ hours daily to dedicate to crypto, these strategies will likely cost you money - not make it.

The solution? Strategies designed specifically for people with limited time. Let's explore what actually works.

PASSIVE INCOME STRATEGIES

The most successful part-time crypto investors share common strategies that require minimal daily attention while maximizing long-term returns. Here are the five proven methods for 2026:

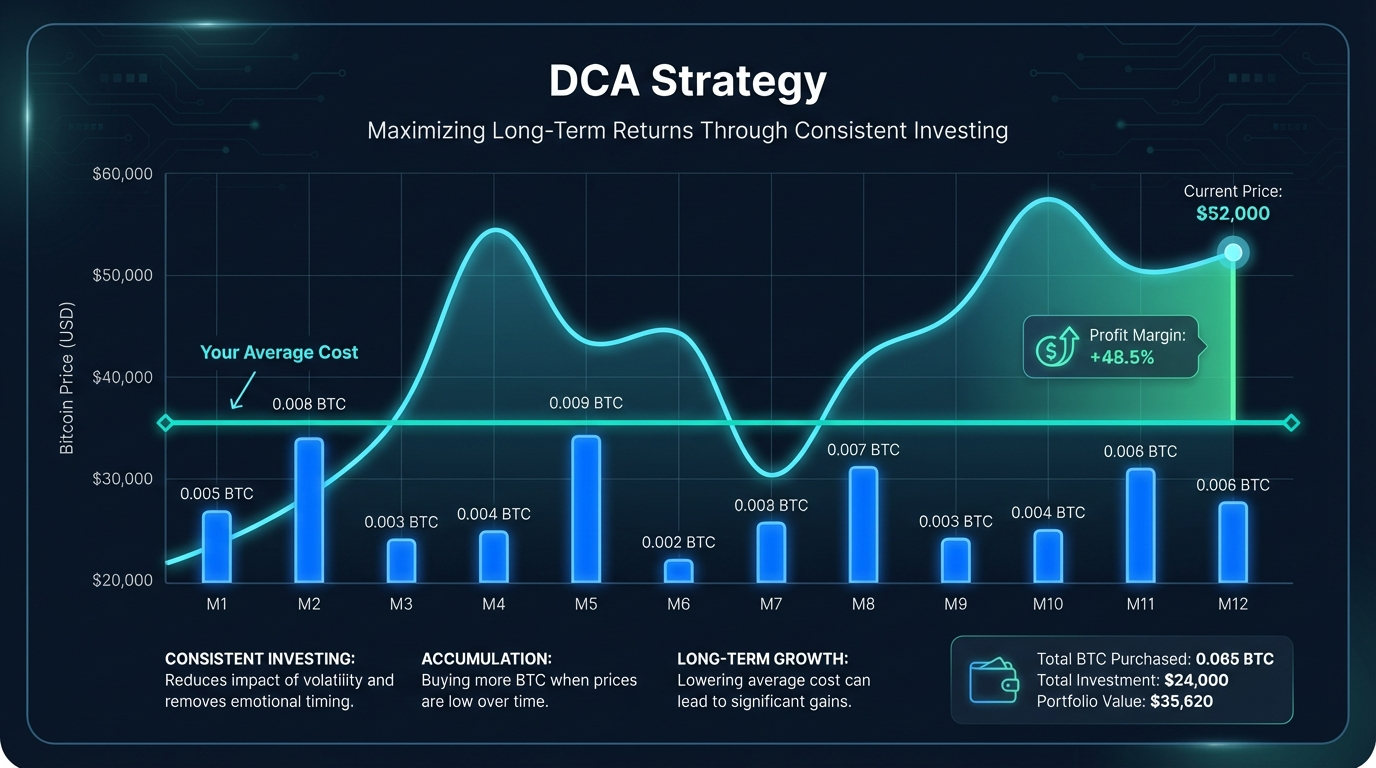

Strategy 1: Dollar-Cost Averaging (DCA)

DCA is the practice of investing a fixed amount at regular intervals, regardless of market conditions. Instead of trying to time the perfect entry point (which even professionals fail at), you spread your purchases over time.

Why DCA Works for Busy Professionals:

- Removes emotion from investing. When Bitcoin drops 20% during your workday, you don't panic sell - your automated buy order executes at the lower price, improving your average cost basis.

- Requires zero market timing. Set up a recurring purchase of $50-200 per week, and forget about it.

- Historically outperforms lump-sum investing in volatile markets like crypto, according to multiple research studies.

- Works on autopilot. Platforms like Coinbase, Binance, and Kraken support automated recurring buys.

Research shows weekly DCA often outperforms monthly in volatile markets. A $10 weekly Bitcoin investment from 2019-2024 yielded 202% returns - outperforming gold and the S&P 500. Set your recurring buy for Friday evenings when markets historically show lower prices.

Strategy 2: Crypto Staking

Staking involves locking your cryptocurrency to help validate blockchain transactions, earning rewards in return. Think of it as earning interest on a savings account - but with significantly higher yields.

Current Staking APY Rates (January 2026):

📊 Staking APY Comparison - January 2026

| Asset | APY Range | Lock-up | Best Platforms | Difficulty |

|---|---|---|---|---|

| Ethereum (ETH) | 2.9-4% | Variable | Lido, Rocket Pool, Coinbase | Easy |

| Solana (SOL) | 6-8% | ~2 days | Marinade, Jito, Binance | Easy |

| Cardano (ADA) | 3-5% | None ✓ | Daedalus, Yoroi, Binance | Very Easy |

| Polkadot (DOT) | 12-14% | 28 days | Polkadot.js, Kraken | Medium |

| Cosmos (ATOM) | 15-19% | 21 days | Keplr, Cosmostation | Medium |

| Avalanche (AVAX) | 8-11% | 14 days | Avalanche Wallet, Binance | Medium |

*APY rates as of January 2026. Rates vary by platform and validator. Always verify current rates before staking.

For busy professionals, start with Cardano (ADA) staking - it has no lock-up period, meaning you can withdraw anytime if needed. Once comfortable, diversify into higher-yield options like Polkadot or Cosmos.

For more details on staking strategies, check out our comprehensive staking guide.

Strategy 3: Liquid Staking (2026 Trend)

Liquid staking is the hottest trend in 2026 crypto. It lets you stake assets while maintaining liquidity - you receive a liquid token (like stETH) representing your staked position, which you can use in DeFi or sell anytime.

Key Liquid Staking Platforms:

- Lido (stETH): Largest liquid staking protocol, V3 upgrade in 2026 adds modular vaults

- Rocket Pool (rETH): More decentralized, slightly lower fees

- Marinade (mSOL): Leading Solana liquid staking

Why It Matters: The U.S. Treasury is expected to approve ETF staking in 2026, allowing funds like BlackRock's spot ETH ETF to stake holdings. This legitimizes liquid staking and could drive institutional adoption.

Advanced users can "restake" their liquid staking tokens through protocols like EigenLayer to earn additional yield. However, this adds complexity and risk - only consider after you're comfortable with basic staking.

Strategy 4: Crypto Lending

Earn passive income by lending your crypto to borrowers through DeFi protocols or centralized platforms. This works especially well for stablecoins where you don't have price volatility risk.

Current Lending Rates (January 2026):

| Asset | APY Range | Top Platforms |

|---|---|---|

| USDC/USDT | 8-18% | Aave, Compound, Nexo |

| Bitcoin | 10-12% | Nexo, YouHodler |

| Ethereum | 10-12% | Aave, Compound |

Warning: Several lending platforms collapsed in 2022-2023 (Celsius, BlockFi). Only use reputable platforms with transparent reserves and audit history.

Strategy 5: Automated DCA Bots + Price Alerts

The secret weapon of successful part-time investors is automation. DCA bots and portfolio trackers work 24/7, executing your strategy even while you're in meetings or sleeping.

Best Tools for Automation:

- Deltabadger - Simple, set-and-forget DCA bot. Set your amount, frequency, and assets. The bot executes trades automatically.

- 3Commas - Advanced features for combining DCA with conditional triggers (buy extra during dips).

- CoinStats / Delta - Portfolio trackers that show all holdings in one dashboard across exchanges.

- TradingView - Set price alerts for key levels so you're notified only when action might be needed.

The Perfect Daily Schedule for Part-Time Crypto Investors

Here's the exact time allocation that successful part-time crypto investors use:

⏰ Daily Schedule for Working Professionals

- Check portfolio app for overnight changes

- Review any price alerts

- Scan headlines for major news

- No trading - just awareness

- Quick read of crypto news (CoinDesk, Decrypt)

- Check Twitter/X for trending topics

- Note anything for weekend research

- Don't act impulsively - note, don't trade

- Deeper analysis if needed

- Check staking rewards accumulation

- Verify DCA orders executed correctly

- Plan weekend research topics

- Research new projects or protocols

- Read whitepapers if evaluating new positions

- Analyze portfolio performance vs. benchmarks

- Rebalance if necessary (quarterly recommended)

- Plan the coming week's strategy

⚠ Golden Rule: Never check crypto prices after 10 PM. Late-night emotional decisions are the fastest way to lose money.

Step-by-Step: Building Your Part-Time Crypto Portfolio

Follow this proven process to build a crypto portfolio designed for long-term success with minimal time investment.

🚀 Portfolio Building: Step-by-Step

Start with 1-2 reputable exchanges that support recurring buys. Recommended: Coinbase (beginner-friendly), Kraken (advanced), Binance (best rates globally).

Starting capital: $500-$1,000 recommended minimum. Monthly DCA: $100-$500 depending on income. Only invest what you can afford to lose.

Allocate majority to established assets: 50% Bitcoin (BTC) + 25-30% Ethereum (ETH). These are your long-term holds with lowest relative risk.

Add yield-generating assets: SOL, ADA, DOT, or ATOM. These provide passive income while you hold. Start with one, add more as you learn.

Set up weekly recurring buys for BTC and ETH. Enable auto-staking for staking assets. Configure price alerts for ±10% moves.

Rebalance every 3 months if allocations drift >10% from targets. Otherwise, let automation do its work. Resist the urge to tinker.

Sample Portfolio Allocations

Different allocation strategies based on risk tolerance:

| Strategy | BTC | ETH | Staking Alts | Stablecoins | Risk Level |

|---|---|---|---|---|---|

| Conservative | 60% | 25% | 10% | 5% | Low |

| Balanced | 50% | 25% | 20% | 5% | Medium |

| Growth | 40% | 30% | 25% | 5% | Higher |

For most working professionals, the Balanced approach provides the best mix of growth potential and manageable risk.

Only rebalance when an asset drifts more than 10% from its target allocation. If BTC grows to 65% of your portfolio (target: 50%), sell 15% and redistribute. This locks in gains systematically without emotional decisions.

Real Numbers: What Can You Actually Expect?

Let's get specific about realistic returns. No hype, just math based on current 2026 rates.

🧮 Realistic Annual Returns Calculator

📊 Year 1 Breakdown:

*Assumes stable crypto prices (no appreciation). **Historical average appreciation varies 5-15% annually for diversified portfolios, but can be negative in bear markets. Past performance ≠ future results.

Long-Term Projections (5-Year Scenario)

| Year | Total Invested | Staking Rewards | Portfolio Value* |

|---|---|---|---|

| 1 | $7,400 | $370 | $7,770 - $8,500 |

| 2 | $9,800 | $780 | $10,580 - $12,500 |

| 3 | $12,200 | $1,250 | $13,450 - $17,000 |

| 4 | $14,600 | $1,800 | $16,400 - $22,000 |

| 5 | $17,000 | $2,450 | $19,450 - $28,000+ |

*Range assumes 0-8% average annual price appreciation. Actual results vary significantly based on market conditions.

- Bitcoin ETF staking approvals expected

- Institutional adoption accelerating

- CLARITY Act regulatory clarity

- BTC at ~$95K with $75K-$150K range projected

- Post-halving supply reduction effects

- Macro uncertainty (Fed policy, recession)

- Potential regulatory setbacks

- Exchange/platform insolvency risk

- High volatility remains (20-50% swings)

- Geopolitical and tariff impacts

Understanding the Risks

No investment is without risk, and crypto carries unique challenges. Here's what you need to know:

1. Volatility Risk

Crypto prices can swing 20-50% within weeks. With Bitcoin's 2026 range projected at $75,000-$150,000, a $10,000 portfolio could fluctuate $2,000-$5,000 in value. DCA helps smooth this out over time.

2. Platform/Exchange Risk

Even reputable exchanges can face issues. In 2022-2023, platforms like Celsius and BlockFi collapsed. Never keep more than 20-30% of holdings on any single exchange. Consider hardware wallets for long-term holdings.

3. Staking Risks

- Slashing: Validators who misbehave can have stakes partially destroyed

- Lock-up periods: Your funds may be inaccessible for days or weeks

- Smart contract risk: DeFi protocols can have bugs exploited

4. Regulatory Risk

While 2026 brings more clarity (GENIUS Act, CLARITY Act), regulations can still change. Diversify across compliant platforms.

- Only invest what you can afford to lose entirely. Crypto can go to zero.

- Never use leverage or margin as a part-time investor.

- Diversify across 2-3 exchanges to reduce platform risk.

- Use hardware wallets for holdings above $5,000.

- Never share seed phrases - not even with "support" staff.

Tax Implications for 2026

Crypto taxes are unavoidable. Here's what working professionals need to know:

Taxable Events

- Selling crypto for fiat (USD, EUR, etc.)

- Trading one crypto for another (e.g., BTC → ETH)

- Receiving staking rewards (taxed as income when received)

- Using crypto to purchase goods/services

Staking Rewards Taxation

In most jurisdictions, staking rewards are taxed as ordinary income at their fair market value when received. If you earn 1 ETH in staking rewards when ETH = $3,400, you owe income tax on $3,400.

When you later sell that ETH, you'll also owe capital gains tax on any appreciation from when you received it.

Capital Gains Rates (U.S. 2026)

- Short-term (held < 1 year): Taxed as ordinary income (up to 37%)

- Long-term (held > 1 year): 0%, 15%, or 20% depending on income bracket

Use a portfolio tracker like CoinTracker, Koinly, or CoinLedger that automatically calculates your tax obligations. Reconstructing transaction history years later is extremely difficult and expensive. Start tracking now - most tools have free tiers for small portfolios.

Essential Tools for Part-Time Crypto Investors

Success as a part-time investor depends heavily on using the right tools to automate and simplify your workflow.

🛠 The Part-Time Investor Toolkit

📱 Portfolio Trackers

🤖 DCA Automation

📊 News & Research

🔒 Security

Top Platform Comparison for 2026

| Platform | Best For | Staking | DCA | Fees | Security |

|---|---|---|---|---|---|

| Coinbase | Beginners | ✓ Limited | ✓ Easy | Higher | ⭐⭐⭐⭐⭐ |

| Kraken | All levels | ✓ Excellent | ✓ | Low | ⭐⭐⭐⭐⭐ |

| Binance | Advanced | ✓ Best rates | ✓ | Lowest | ⭐⭐⭐⭐ |

| Lido | ETH Staking | ✓ Liquid | - | 10% rewards | ⭐⭐⭐⭐ |

| Nexo | Lending | ✓ | - | 0% | ⭐⭐⭐⭐ |

For more on Bitcoin-specific strategies, see our Bitcoin investment guide.

7 Mistakes Part-Time Investors Must Avoid

Based on analysis of thousands of investor journeys, here are the most common pitfalls:

❌ 7 Mistakes to Avoid

Professional day traders spend 40+ hours weekly. You can't compete in your lunch break. Use DCA and staking instead.

A 10x leveraged position can be liquidated in a 10% dip. If you're not watching 24/7, you'll lose everything during volatility spikes.

Hourly price checking leads to emotional decisions. Set alerts, check twice daily max, and let automation work.

Remember Celsius? FTX? Diversify across 2-3 platforms. Use hardware wallets for amounts over $5,000.

By the time you hear about a hot coin, insiders have already profited. Stick to your allocation plan.

Reconstructing a year of transactions is a nightmare. Use tax tracking software from day one.

Bear markets are when DCA shines. Continue buying at lower prices - you're improving your long-term cost basis. Learn more in our bear market survival guide.

Frequently Asked Questions

❓ Frequently Asked Questions

How much time do I really need to invest in crypto while working full-time?

The minimum effective time investment is 30-60 minutes per day for monitoring, plus 2-4 hours on weekends for research and strategy review. With proper automation (DCA bots, portfolio trackers, price alerts), you can reduce active time to as little as 15-20 minutes daily while still building a solid portfolio.

What's the minimum amount I should start with?

You can technically start with as little as $50-100, but for meaningful results, aim for at least $500-$1,000 initial investment plus $100-$200 monthly DCA contributions. This allows you to build positions across multiple assets while keeping fees proportionally reasonable.

Is day trading possible with a full-time job?

No, and attempting it is the fastest way to lose money. Professional day traders spend 4-8 hours actively monitoring markets with sophisticated tools. Trying to trade during lunch breaks or between meetings puts you at a severe disadvantage. Statistics show 90-95% of day traders lose money - and that's full-time traders.

Should I use leverage as a part-time investor?

Absolutely not. Leveraged positions can be liquidated within minutes during volatility spikes. If you're away from your screen during a flash crash, you could lose your entire position. Part-time investors should only use spot trading with money they can afford to hold through drawdowns.

How do I handle crypto during bear markets?

This is where DCA shines. Continue your automated purchases through bear markets - you're buying more crypto at lower prices, improving your long-term cost basis. Historically, investors who maintained DCA through bear markets saw the strongest gains when markets recovered.

What about taxes on staking rewards?

In most jurisdictions, staking rewards are taxed as ordinary income at their fair market value when received. When you later sell, you'll also owe capital gains tax on any appreciation. Use a portfolio tracker like CoinTracker or Koinly that automatically calculates your tax obligations. Keep detailed records from day one.

Can I make $100 a day in crypto passive income?

$100/day = $36,500/year. At 5% staking APY, you'd need $730,000 in staking assets. At 10% APY (higher-risk assets), you'd need $365,000. For most part-time investors, realistic passive income is $200-600/month on a $10,000 portfolio. Think long-term wealth building, not quick daily income.

Is DCA better than lump sum investing?

In highly volatile markets like crypto, DCA often outperforms lump sum for risk-adjusted returns. Research shows a $10 weekly Bitcoin investment from 2019-2024 yielded 202% returns. DCA removes emotion, prevents buying at peaks, and builds disciplined investing habits.

Can I lose money staking crypto?

Yes, through several mechanisms: (1) The underlying token price drops more than your staking rewards, (2) Slashing events where validators misbehave, (3) Platform/protocol failure or hacks, (4) Smart contract exploits. Always stake on reputable platforms and understand the risks.

Can I reach financial independence through part-time crypto investing?

Realistic expectations: part-time crypto investing can provide meaningful supplemental income and long-term wealth building, but it's unlikely to replace your primary income within 1-2 years. Think of it as a powerful addition to your overall investment portfolio, not a get-rich-quick scheme. Consistent execution over 5-10 years is where life-changing results become possible.

Key Takeaways

🎯 Key Takeaways

- Success = Systems, Not Time. Automate with DCA, staking, and portfolio trackers.

- 30-60 min/day is enough. Weekend research (2-4 hours) handles the rest.

- Avoid day trading and leverage. 90%+ of day traders lose money.

- DCA + Staking = Passive growth. 5-15% APY compounds significantly over years.

- Diversify platforms. Never keep >30% on any single exchange.

- Track taxes from day one. Use CoinTracker, Koinly, or similar tools.

- Think 5-10 years, not 5-10 months. Consistency beats timing.

Conclusion

Balancing a full-time job and crypto investing isn't just possible - it's the approach most successful investors actually use. The key is abandoning the myth that success requires constant monitoring and embracing strategies built for your reality: limited time, consistent execution, and a long-term horizon.

With Bitcoin at ~$95,000, regulatory clarity improving through the GENIUS and CLARITY Acts, and institutional adoption accelerating, 2026 presents a compelling opportunity to build meaningful crypto wealth - without sacrificing your career or sanity.

Start small, automate everything possible, and stay disciplined through market cycles. Your future self will thank you for beginning today.

Ready to Start Your Crypto Journey?

Join thousands of working professionals building wealth through smart, automated crypto strategies.

Get Started Free →Investment Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency investments are highly volatile and speculative. You could lose some or all of your invested capital. Past performance does not guarantee future results. Always conduct your own research (DYOR) and consider consulting with a qualified financial advisor before making any investment decisions. The staking APY rates, price projections, and platform recommendations mentioned are based on data available as of January 2026 and may change. Zipmex does not guarantee the accuracy of third-party information referenced in this article.