The crypto market enters 2026 with unprecedented momentum. According to DeFiLlama data, total DeFi TVL has recovered to over $180 billion, while stablecoin market capitalization has reached $314-318 billion - a clear signal of institutional capital returning to the ecosystem.

If you're looking for the best upcoming ICO and TGE opportunities, understanding the dominant narratives is essential. This comprehensive guide analyzes the 10 hottest crypto sectors driving token launches in 2026, complete with verified data, market metrics, and actionable insights for identifying high-potential projects.

Whether you're interested in DeFi innovations, tokenization of real-world assets, or emerging technologies like fully homomorphic encryption, this guide will help you navigate the most promising investment opportunities.

📊 2026 Crypto Market Snapshot

Why Perpetual DEXs Dominate 2026

The perpetual decentralized exchange sector has emerged as one of the strongest crypto narratives. Leading the charge is Hyperliquid, which has achieved remarkable metrics without any venture capital funding.

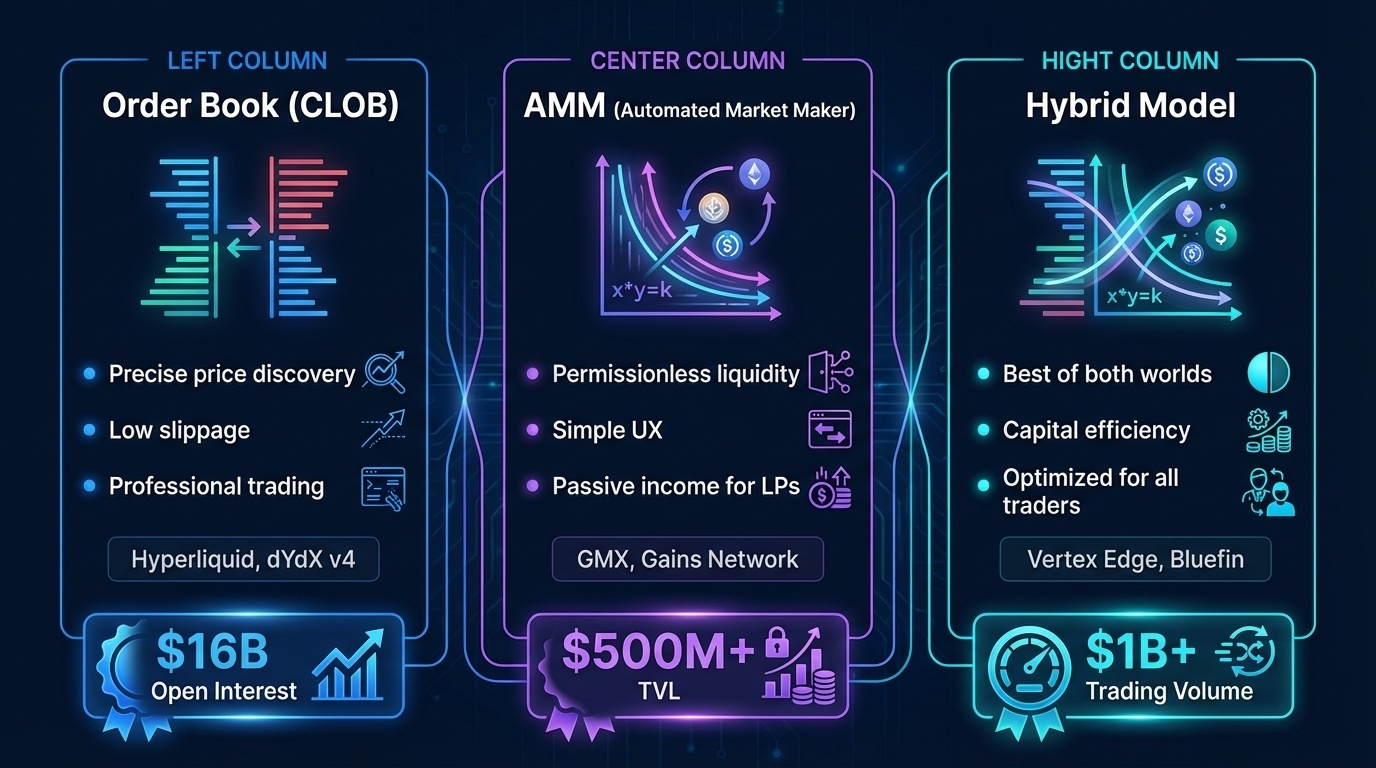

According to CoinDesk reporting, Hyperliquid's total value locked reached approximately $6 billion by late 2024, while its open interest surged to $16 billion - a 4x increase from $4 billion earlier in the year. The platform recorded daily trading volumes peaking at $32 billion and attracted over 1.4 million users, up from 300,000 in early 2024.

What makes Hyperliquid particularly notable is its community-first approach: 100% of trading fees are distributed to the community, with no allocation to venture capitalists. This model generated peak daily revenue of approximately $20 million.

🔑 Key Metrics: Hyperliquid (January 2026)

| Total Value Locked | $6 Billion |

| Open Interest | $16 Billion |

| Peak Daily Volume | $32 Billion |

| Total Users | 1.4 Million+ |

| VC Funding | $0 (Community-owned) |

What to Look for in Perp DEX ICOs

When evaluating upcoming perpetual DEX token launches, focus on:

- Order book vs. AMM architecture - Hybrid models like Hyperliquid's central limit order book (CLOB) offer better capital efficiency

- Fee distribution mechanisms - Projects sharing revenue with token holders create sustainable tokenomics

- Cross-margin capabilities - Multi-asset collateral systems enhance user flexibility

- Liquidity depth - Check open interest relative to TVL ratios

The $16 Trillion Opportunity

Real-world asset tokenization represents one of the most significant bridges between traditional finance and crypto. According to Boston Consulting Group projections, the tokenized asset market could reach $16 trillion by 2030, with some optimistic forecasts suggesting up to $30 trillion.

The current market has already achieved substantial scale. Total RWA tokenization value reached approximately $33-35 billion by 2025-2026, with tokenized US Treasuries alone accounting for $8.7 billion on-chain.

Institutional Leaders in RWA

BlackRock's BUIDL Fund has emerged as the dominant force in tokenized treasuries, achieving assets under management between $1.8 billion to $2.3 billion - making it the largest tokenized treasury fund globally.

Other significant players include:

- Franklin Templeton OnChain US Government Money Fund: $650 million AUM

- Ondo Finance: Over $500 million in tokenized securities

RWA ICO Evaluation Criteria

For upcoming RWA token launches, assess:

- Regulatory compliance - Proper licensing and security token status

- Underlying asset quality - Treasury-backed vs. real estate vs. commodities

- Yield mechanisms - How tokenholders capture real-world returns

- Institutional partnerships - Backing from established financial institutions

- Chain selection - Ethereum dominates, but Solana and Avalanche are gaining traction

A $20 Billion Sector Emerges

Prediction markets have emerged as perhaps the most explosive crypto narrative of 2025-2026. The sector's growth accelerated dramatically following the 2024 US election, with platforms achieving unprecedented scale and institutional validation.

Polymarket, the leading decentralized prediction market, achieved a valuation of $9 billion following a $2 billion investment from ICE (Intercontinental Exchange), the parent company of the New York Stock Exchange. The platform has processed cumulative trading volume exceeding $33.4 billion.

Kalshi, the regulated US-based competitor, has achieved even higher institutional validation with an $11 billion valuation following a $1.1 billion Series E round. The platform recorded $5.8 billion in monthly trading volume during November 2025.

🎯 Prediction Markets: Head-to-Head Comparison

| Metric | Polymarket | Kalshi |

|---|---|---|

| Valuation | $9 Billion | $11 Billion |

| Key Investment | $2B from ICE/NYSE | $1.1B Series E |

| Cumulative Volume | $33.4B | N/A (newer) |

| Monthly Volume (Nov '25) | ~$10.6B | $5.8B |

| Model | Decentralized (Polygon) | Regulated (CFTC-licensed) |

Traditional Finance Enters the Arena

The institutional validation of prediction markets extends beyond crypto-native platforms. According to reports, Robinhood has identified prediction markets as its fastest-growing product line ever, signaling mainstream adoption.

Investment bank Piper Sandler projects that prediction market platforms could process 445 billion contracts in 2026, representing approximately $222.5 billion in notional value.

Prediction Market ICO Opportunities

Emerging opportunities in this sector include:

- Decentralized oracle solutions - Resolution mechanisms for prediction outcomes

- Liquidity layer protocols - AMMs optimized for binary/multi-outcome markets

- Cross-chain prediction aggregators - Unified access across multiple platforms

- AI-powered analysis tools - Platforms leveraging machine learning for market insights

Bittensor Leads the AI Crypto Revolution

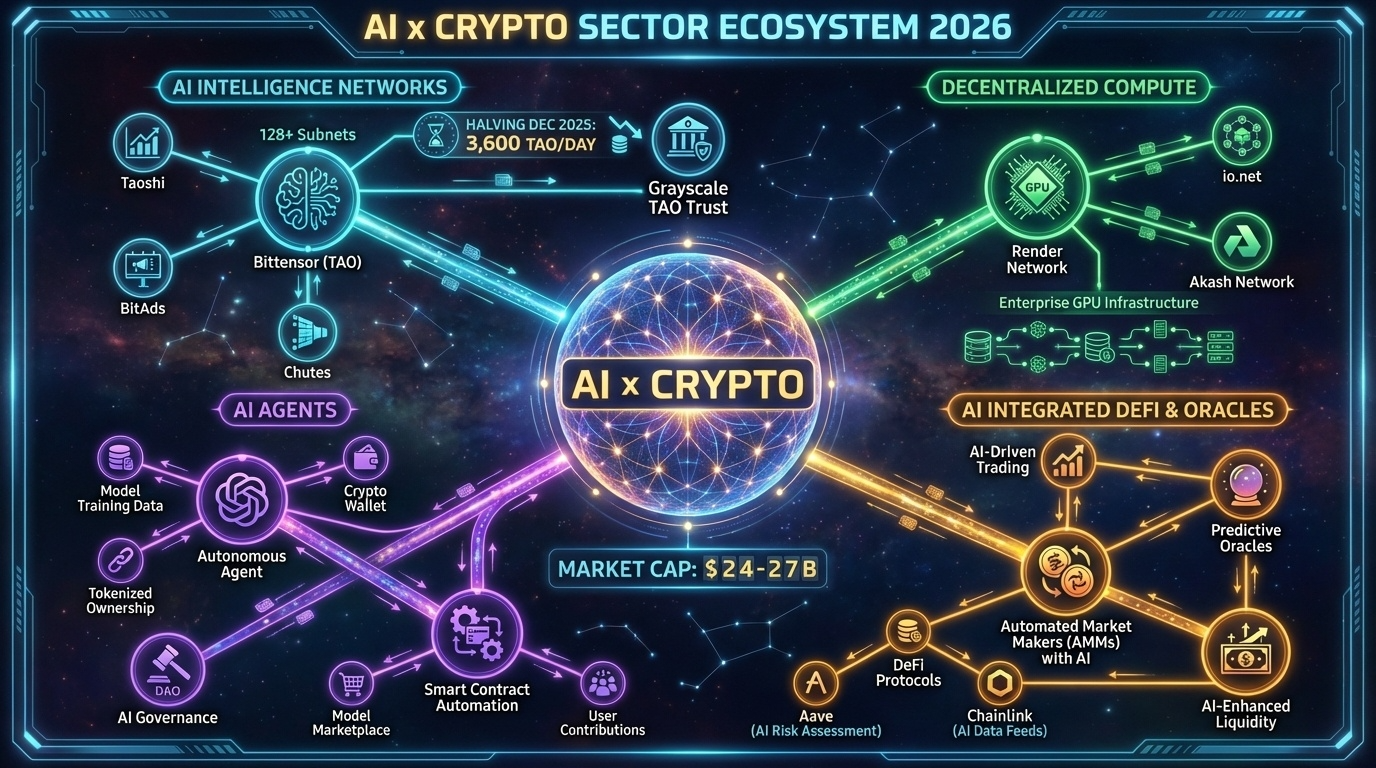

The intersection of artificial intelligence and blockchain continues to generate significant innovation. Bittensor (TAO) has emerged as the flagship project, operating a decentralized network of over 128 specialized subnets spanning AI inference, DevOps automation, and data querying.

With a market capitalization of approximately $2.55-2.9 billion, Bittensor represents one of the largest AI-focused crypto projects. The network completed its first halving in December 2025, reducing daily emissions from 7,200 TAO to 3,600 TAO per day - mirroring Bitcoin's scarcity model while adding AI utility-driven demand.

Institutional interest in Bittensor has grown substantially. Grayscale filed an S-1 for a TAO Trust seeking to provide regulated exposure to the asset, potentially following the path of successful Bitcoin and Ethereum ETFs.

🤖 Bittensor Network Stats (January 2026)

AI Crypto Sector Overview

The broader AI x Crypto sector has grown to an estimated $24-27 billion total market capitalization as of mid-2025. Key sub-sectors include:

- Decentralized Compute: Render Network, io.net, Akash Network expanding enterprise GPU capacity

- AI Agent Infrastructure: Platforms enabling autonomous AI agents with crypto wallets

- Data Marketplaces: Ocean Protocol and similar projects for AI training data

- Inference Networks: Distributed inference for large language models

AI ICO Evaluation Framework

When assessing AI crypto token launches:

- Compute economics - Cost efficiency vs. centralized cloud providers

- Network effects - Developer and user adoption metrics

- Revenue model - Sustainable tokenomics beyond speculation

- Technical differentiation - Novel approaches vs. repackaged concepts

- Team credentials - AI/ML expertise combined with crypto experience

Zama: First FHE Unicorn

Fully Homomorphic Encryption enables computation on encrypted data without decryption - a breakthrough with profound implications for blockchain privacy. Zama has emerged as the sector leader, achieving unicorn status with over $1 billion valuation.

The company has raised approximately $150 million in total funding, including a $57 million Series B round led by Blockchange and Pantera Capital.

🔐 Zama FHE Roadmap

Other FHE Projects to Watch

The FHE crypto landscape includes several emerging players:

- Fhenix: Raised $15 million in Series A, planning mainnet Q1 2026

- Inco Network: Building FHE-powered confidential computing

- Mind Network: FHE solutions for AI data privacy

FHE ICO Considerations

This nascent sector requires careful evaluation:

- Performance benchmarks - Current TPS vs. roadmap claims

- Cryptographic approach - TFHE vs. BGV vs. CKKS schemes

- Developer tools - Quality of SDKs and documentation

- Use case focus - DeFi privacy, confidential AI, enterprise applications

Babylon Protocol: $6 Billion in Bitcoin Staked

Bitcoin Layer 2 solutions and staking mechanisms represent a fundamental evolution for the largest cryptocurrency by market cap. Babylon Protocol has emerged as the leading Bitcoin staking project, achieving approximately $5-6 billion in total value locked.

The protocol completed its third staking round in late 2024, bringing total BTC staked to 57,290 BTC (approximately $5.93 billion at the time). This positions Babylon among the top 10 protocols by TVL across all blockchains.

₿ Bitcoin DeFi Ecosystem (January 2026)

BOB: Hybrid Layer-2 for Bitcoin DeFi

BOB (Build on Bitcoin) represents an innovative approach to Bitcoin scaling. As a "hybrid Layer-2," BOB integrates with Babylon to achieve "Bitcoin finality" - the point at which transactions become permanent and irreversible on the Bitcoin blockchain.

According to CoinDesk, this integration allows BOB to leverage Babylon's security guarantees while enabling DeFi applications that weren't previously possible on Bitcoin.

Bitcoin L2 ICO Evaluation

Key metrics for Bitcoin Layer 2 token launches:

- Security model - How closely tied to Bitcoin's security guarantees

- BTC integration - Native BTC support vs. wrapped tokens

- Babylon compatibility - Access to the dominant staking infrastructure

- DeFi ecosystem - Quality of lending, DEX, and yield protocols

Market Reaches New Heights

Stablecoins have become the foundational infrastructure of crypto markets. Total stablecoin market capitalization reached $314-318 billion by January 2026, with some projections suggesting the market could reach $1 trillion by end of 2026 and $2 trillion by 2028.

Tether (USDT) maintains dominant market share at $187 billion, representing approximately 60.68% of the total stablecoin market. Daily trading volume regularly exceeds $100 billion.

💵 Stablecoin Market Landscape (January 2026)

| Stablecoin | Market Cap | Market Share | Type |

|---|---|---|---|

| USDT (Tether) | $187B | 60.68% | Fiat-backed |

| USDC (Circle) | $75.7B | ~24% | Fiat-backed |

| USDe (Ethena) | $14.4B | ~4.6% | Synthetic (Delta-neutral) |

| DAI (MakerDAO) | $5.3B | ~1.7% | Crypto-collateralized |

| Others | $31.6B | ~10% | Various |

Ethena's Synthetic Dollar Innovation

Ethena's USDe represents a new category of stablecoin innovation, achieving $14.4 billion market cap through a delta-neutral hedging strategy. Unlike fiat-backed stablecoins, USDe maintains its peg through perpetual futures positions, offering native yield generation.

Stablecoin ICO Opportunities

Emerging opportunities in the stablecoin sector:

- Yield-bearing stablecoins - Protocols offering native interest

- RWA-backed alternatives - Treasury and real estate collateral

- Cross-chain liquidity - Unified stablecoin bridges

- Regulatory-compliant options - MiCA and US-compliant designs

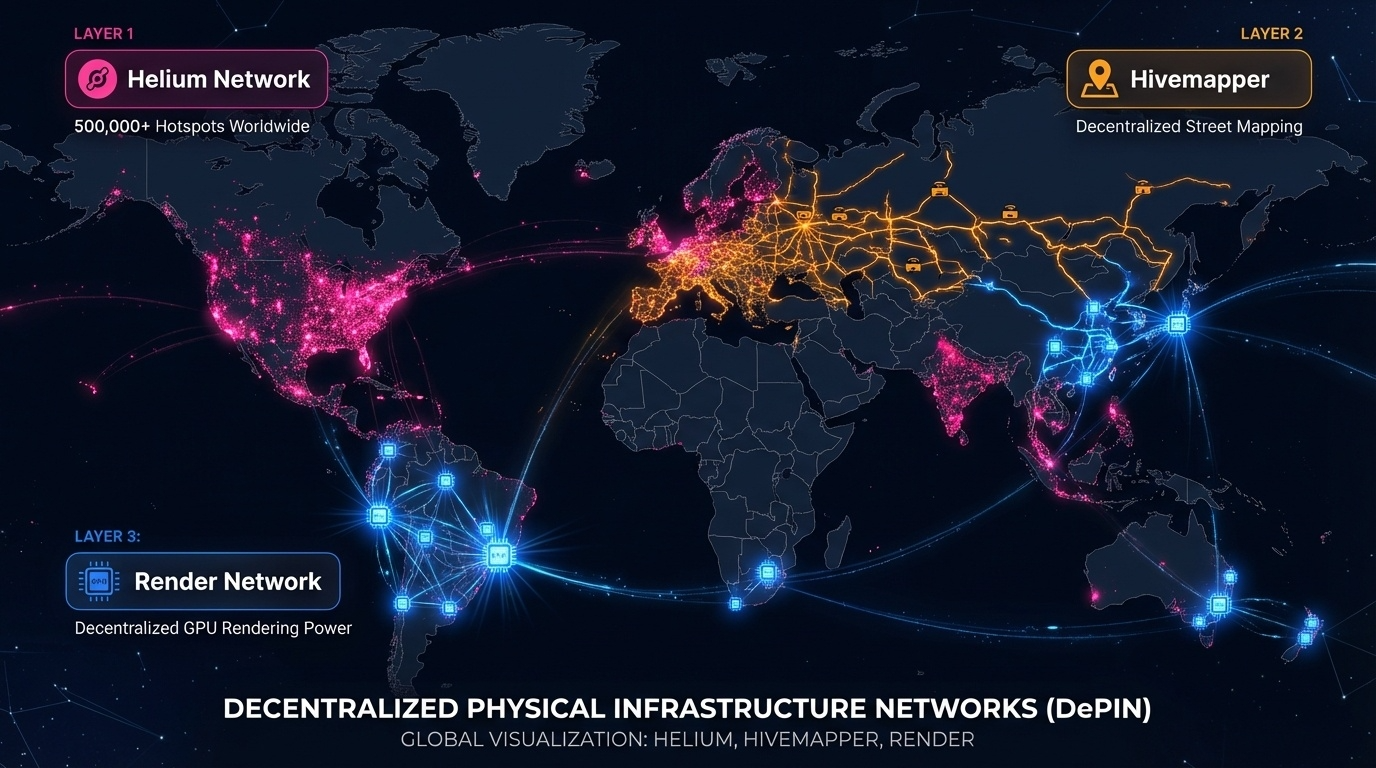

DePIN: Decentralized Physical Infrastructure

Decentralized Physical Infrastructure Networks continue expanding across various use cases:

- Helium (HNT) - IoT and 5G coverage with thousands of active hotspots

- Hivemapper - Decentralized mapping with dash-cam contributors

- Render Network - GPU computing for visual rendering

InfoFi: Information as Financial Asset

The emerging InfoFi (Information Finance) narrative treats data and attention as tradeable assets:

- Kaito - AI-powered crypto intelligence aggregation

- Cookie3 - Marketing attribution for Web3

- Space and Time - Decentralized data warehousing

Restaking and EigenLayer Ecosystem

Following EigenLayer's success, restaking has become a major theme for capital efficiency:

- Enhanced security for new protocols

- Yield optimization through multiple validation roles

- Risk considerations around slashing conditions

Learn more about staking fundamentals and how restaking expands these concepts.

DeSci: Decentralized Science

Decentralized Science aims to revolutionize research funding and IP management:

- VitaDAO - Longevity research funding

- Molecule - IP-NFTs for biotech research

- ResearchHub - Open science publishing incentives

Step 1: Monitor Launch Platforms

Key platforms for discovering ICO and TGE opportunities:

- Token launchpads - Binance Launchpad, Gate.io Startup, KuCoin Spotlight

- DEX launchpads - Uniswap new listings, Raydium AcceleRaytor

- Aggregators - CryptoTotem, ICO Drops, CoinGecko new listings

Step 2: Due Diligence Framework

Before participating in any token launch:

- Team verification - LinkedIn profiles, past projects, doxxed status

- Tokenomics analysis - Vesting schedules, allocation breakdowns, inflation rates

- Technology assessment - GitHub activity, audit reports, testnet functionality

- Market positioning - Competitive landscape, unique value proposition

- Community evaluation - Discord/Telegram activity, genuine engagement vs. bots

⚠ ICO Risk Assessment Matrix

| Risk Factor | Green Flag | Red Flag |

|---|---|---|

| Team | Doxxed, verifiable history | Anonymous, no track record |

| Tokenomics | Long vesting, fair allocation | Short unlock, heavy insider allocation |

| Code | Open source, audited | Closed source, no audit |

| Roadmap | Working product, clear milestones | Vague promises, no MVP |

| Community | Organic growth, genuine discussion | Bot-inflated, only price talk |

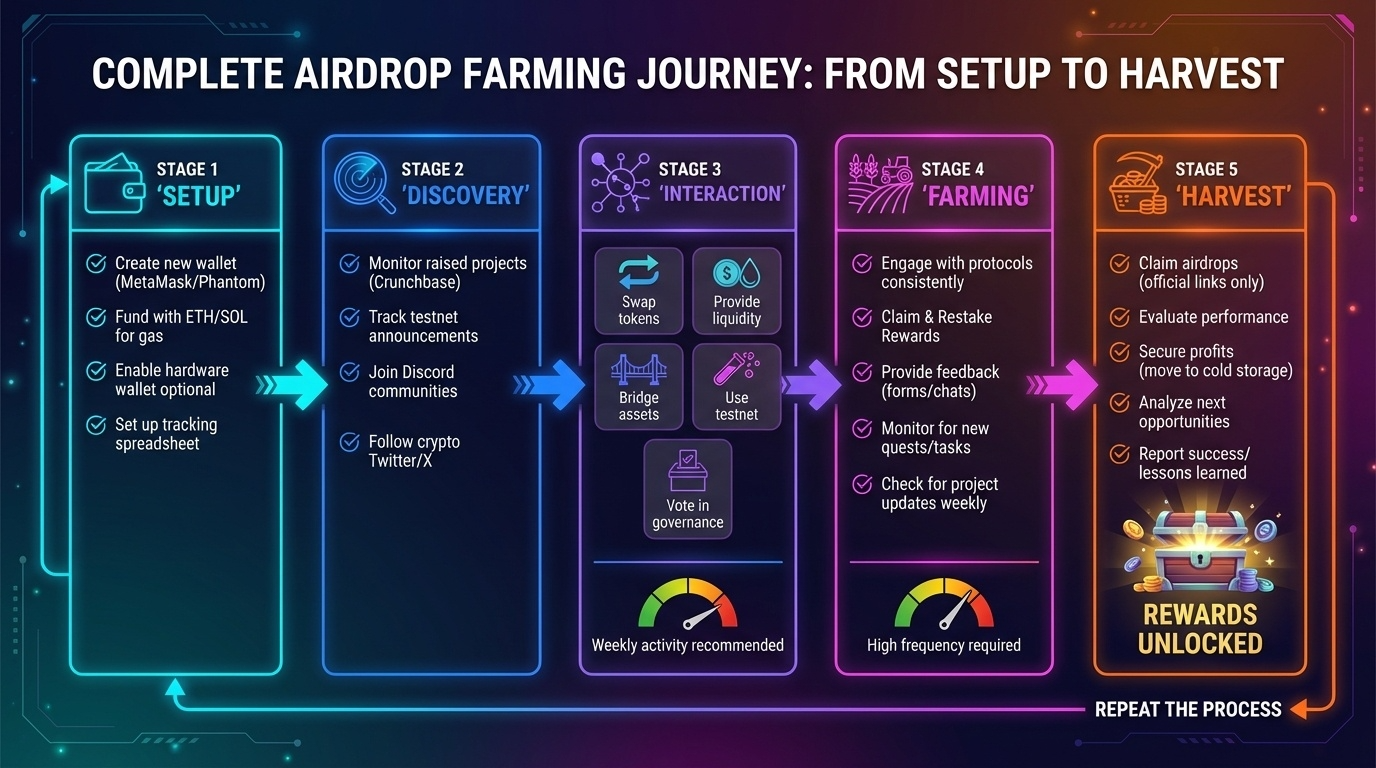

Step 3: Maximize Airdrop Opportunities

Many 2026 projects will distribute tokens through airdrops rather than traditional ICOs. Check out our guides:

- Top Crypto Airdrops Q1 2026

- How to Farm Airdrops in 2026

- How to Spot High-Potential Airdrops and Avoid Scams

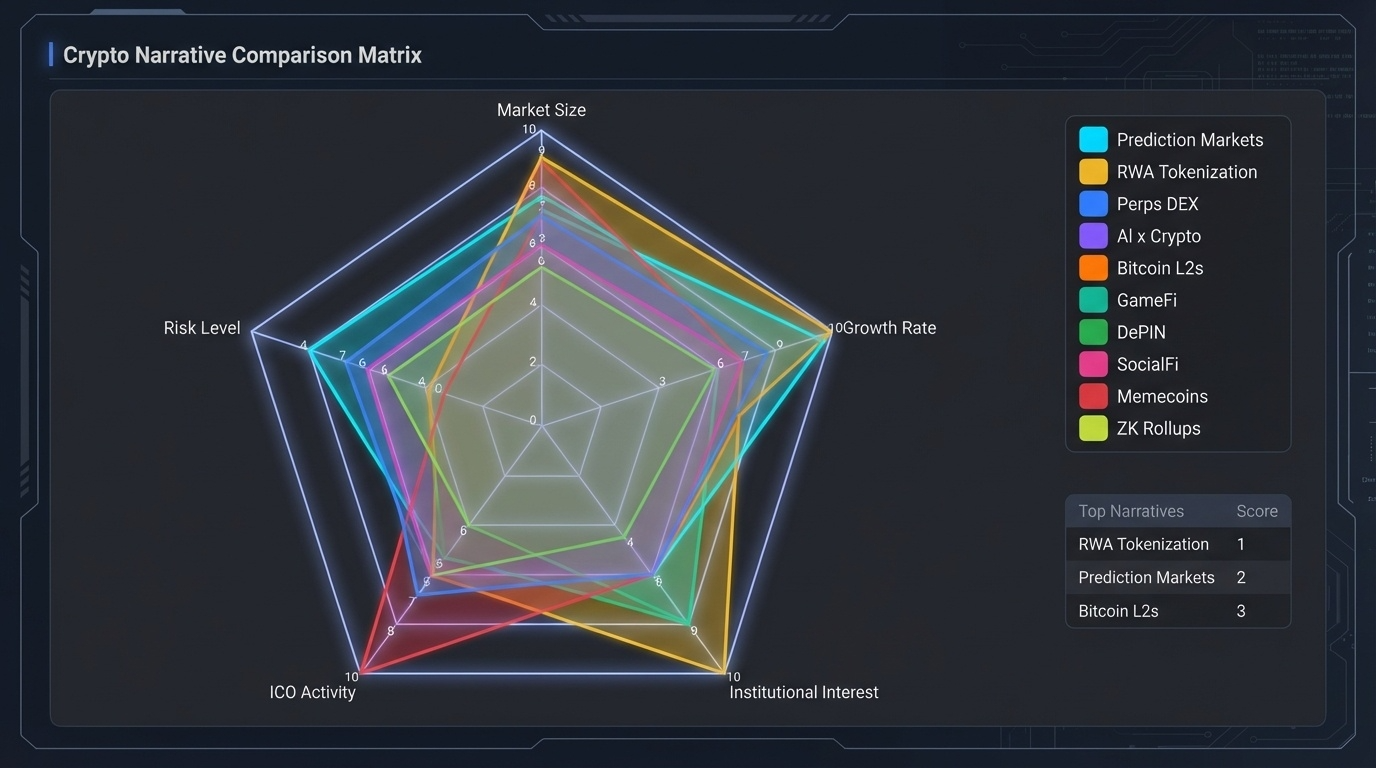

📊 2026 Crypto Narratives: Complete Comparison

| Narrative | Market Size | Top Project | Risk Level | ICO Potential |

|---|---|---|---|---|

| Perps DEX | $6B+ TVL | Hyperliquid | 🟡 Medium | ⭐⭐⭐⭐ |

| RWA | $35B+ | BlackRock BUIDL | 🟢 Low | ⭐⭐⭐⭐⭐ |

| Prediction Markets | $20B valuations | Polymarket/Kalshi | 🟡 Medium | ⭐⭐⭐⭐⭐ |

| AI x Crypto | $24-27B | Bittensor (TAO) | 🟡 Medium | ⭐⭐⭐⭐ |

| FHE | $1B+ (Zama) | Zama/Fhenix | 🔴 High | ⭐⭐⭐ |

| Bitcoin L2s | $6B (Babylon) | Babylon/BOB | 🟡 Medium | ⭐⭐⭐⭐ |

| Stablecoins | $314B+ | USDT/USDC/USDe | 🟢 Low | ⭐⭐⭐ |

| DePIN | $15B+ | Helium/Render | 🟡 Medium | ⭐⭐⭐⭐ |

| Restaking | $15B+ | EigenLayer | 🟡 Medium | ⭐⭐⭐ |

| DeSci | $500M+ | VitaDAO/Molecule | 🔴 High | ⭐⭐ |

❓ Frequently Asked Questions

What is the difference between ICO, IEO, and IDO?

IEO (Initial Exchange Offering): Token sale conducted through a centralized exchange, which vets projects and handles KYC.

IDO (Initial DEX Offering): Token launch on a decentralized exchange, typically through a launchpad like those on Uniswap or Raydium.

What are the hottest crypto narratives for ICOs in 2026?

How much money has flowed into prediction markets?

Is Hyperliquid still relevant in 2026?

What is BlackRock's BUIDL fund?

How big is the stablecoin market in 2026?

What is FHE and why does it matter for crypto?

How much Bitcoin is staked through Babylon?

Are airdrops better than ICOs for getting new tokens?

The best ICO opportunities in 2026 will emerge from projects that solve real problems with sustainable economic models. Whether you're interested in DeFi innovation, tokenized assets, or cutting-edge privacy technology, thorough research remains your most valuable tool.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry significant risk. Always conduct your own research and consider consulting a financial advisor before making investment decisions.