In May 2022, the crypto world witnessed one of its most catastrophic collapses when Terra Luna and its algorithmic stablecoin UST imploded, wiping out over $45 billion in market value within just three days. From the ashes of this disaster emerged Luna Classic (LUNC) - the remnant of what was once a top-10 cryptocurrency.

But is LUNC a phoenix rising from the ashes, or just the smoking ruins of a failed experiment? With Do Kwon now serving a 15-year prison sentence and the community burning billions of tokens monthly, the question remains: is there any hope for LUNC in 2026?

⚡ Quick Answer: What Is Luna Classic?

Luna Classic (LUNC) is the original Terra blockchain's native token that remained after the May 2022 collapse. Currently trading at ~$0.000042-0.000045 (down 99.99% from ATH of $119), LUNC has a circulating supply of 5.47 trillion tokens.

Despite community burn efforts destroying ~436.6 billion tokens (6.7% of supply), LUNC remains a highly speculative asset. Do Kwon, Terra's founder, was sentenced to 15 years in prison in December 2025.

Latest: Binance burned 5.33B LUNC on January 1, 2026, triggering a 20% price rally.

What Is Luna Classic (LUNC)?

Luna Classic is the native cryptocurrency of the Terra Classic blockchain - the original Terra network that was rebranded after the catastrophic collapse in May 2022. Before understanding LUNC, it's essential to grasp what happened to the original Terra ecosystem.

The original Terra blockchain launched in 2018, created by Do Kwon and Daniel Shin through Terraform Labs. At its peak in April 2022, LUNA (as it was then called) reached an all-time high of $119.18 with a market capitalization exceeding $40 billion. The ecosystem centered around UST - an algorithmic stablecoin designed to maintain a $1 peg through a complex mint-and-burn mechanism with LUNA.

After the collapse, the Terra community split into two paths. Do Kwon launched Terra 2.0 (now simply called "Luna" or LUNA) - a completely new blockchain without any algorithmic stablecoin. The original chain was renamed "Terra Classic" with its token becoming LUNC (Luna Classic), and the original UST stablecoin became USTC (TerraClassicUSD).

💡 Pro Tip

The "Classic" suffix is a reference to the Ethereum/Ethereum Classic split after the 2016 DAO hack. Do Kwon himself called the UST collapse "Terra's DAO hack moment."

Is Luna Classic Dead in 2026?

This is the question on every potential investor's mind. Let's examine the facts objectively.

Signs of Life:

- Active community (Terra Rebels) maintaining the chain

- 130+ validators securing the network

- Consistent burn activity (~48-139 million LUNC daily)

- Trading on major exchanges (Binance, KuCoin, Kraken)

- Recent v3.6.1 upgrade with Cosmos SDK improvements

- January 2026 saw 20% price rally after Binance burn

Signs of Struggle:

- Price down 99.99% from ATH

- 5.47 trillion tokens still in circulation

- Founder convicted and imprisoned

- No major DeFi applications rebuilt

- Declining developer activity

- Heavy dependency on Binance (60%+ of burns)

⚠ Reality Check

Luna Classic isn't "dead" in the technical sense - the blockchain operates, transactions process, and the community remains active. However, the chances of LUNC returning to anywhere near its former glory are mathematically negligible. Consider it alive but permanently diminished.

Terra Classic vs Luna 2.0: Key Differences

Understanding the distinction between LUNC and LUNA 2.0 is crucial for anyone researching Terra tokens and cryptocurrencies.

Terra Rebels & Community Governance

After the collapse, Do Kwon abandoned the original Terra Classic chain to focus on Terra 2.0. A community group called Terra Rebels stepped up to maintain and develop the LUNC ecosystem. This decentralized group of developers and community members now effectively controls Terra Classic's future.

The Terra Rebels have implemented several initiatives:

- The 0.5% burn tax on all transactions

- Network upgrades (v22, v3.6.1)

- Cosmos SDK integration improvements

- Proposals for USTC re-pegging attempts

💡 Pro Tip

Unlike most crypto projects controlled by a company, LUNC is now a truly community-governed blockchain. This is both a strength (decentralization) and weakness (slower decision-making, limited resources).

What Happened to Terra Luna? The May 2022 Collapse

To understand LUNC, you need to understand the catastrophe that created it. The Terra collapse remains one of crypto's most devastating events.

How Terra's Algorithmic Stablecoin Worked

Terra's UST was an algorithmic stablecoin - unlike USDT or USDC which are backed by actual dollars, UST maintained its $1 peg through a complex mechanism with LUNA. Here's how staking and burning interacted:

The Mint-Burn Mechanism:

- To create 1 UST, you had to burn $1 worth of LUNA

- To redeem 1 UST, you received $1 worth of newly minted LUNA

- This arbitrage was supposed to keep UST at exactly $1

When It Worked: If UST dropped to $0.99, traders could buy UST cheap and redeem for $1 of LUNA - profit. This buying pressure pushed UST back to $1.

When It Failed: In May 2022, massive UST sell-offs caused the algorithm to mint LUNA exponentially, leading to hyperinflation.

The Death Spiral Timeline

📅 Terra Collapse Timeline (May 2022)

May 7, 2022

UST begins depegging after $2B withdrawal from Anchor Protocol. Drops to $0.985.

May 8-9, 2022

Luna Foundation Guard deploys $1.5B in Bitcoin reserves. UST drops to $0.67.

May 10-11, 2022

Death spiral begins. LUNA supply explodes from 343 million to 1.4 billion in 24 hours.

May 12, 2022

Terra blockchain halted twice. LUNA price crashes from $62 to under $1.

May 13, 2022

LUNA supply reaches 6.53 trillion. Price hits all-time low of $0.000000999967.

May 28, 2022

Terra 2.0 launches. Original chain rebranded to Terra Classic (LUNC).

The Numbers:

- Supply Explosion: 343 million → 6.53 trillion tokens (19,000x increase)

- Price Crash: $119.18 → $0.000001 (99.999999% drop)

- Value Destroyed: Over $45 billion wiped out in one week

- Affected Investors: Millions worldwide, some lost life savings

Do Kwon's Legal Aftermath

Following the collapse, Do Kwon became one of crypto's most wanted fugitives. After months on the run, he was arrested in Montenegro in March 2023 using fake Costa Rican documents.

⚖ Legal Status (January 2026)

- US Sentencing: 15 years prison (December 2025) for securities fraud, wire fraud, commodities fraud, and conspiracy

- South Korean Charges: Pending - faces up to 40+ additional years

- SEC Settlement: Terraform Labs found liable for $4+ billion in fraud

- Class Actions: Patterson v. TerraForm Labs and Singapore lawsuit ($56.9M) ongoing

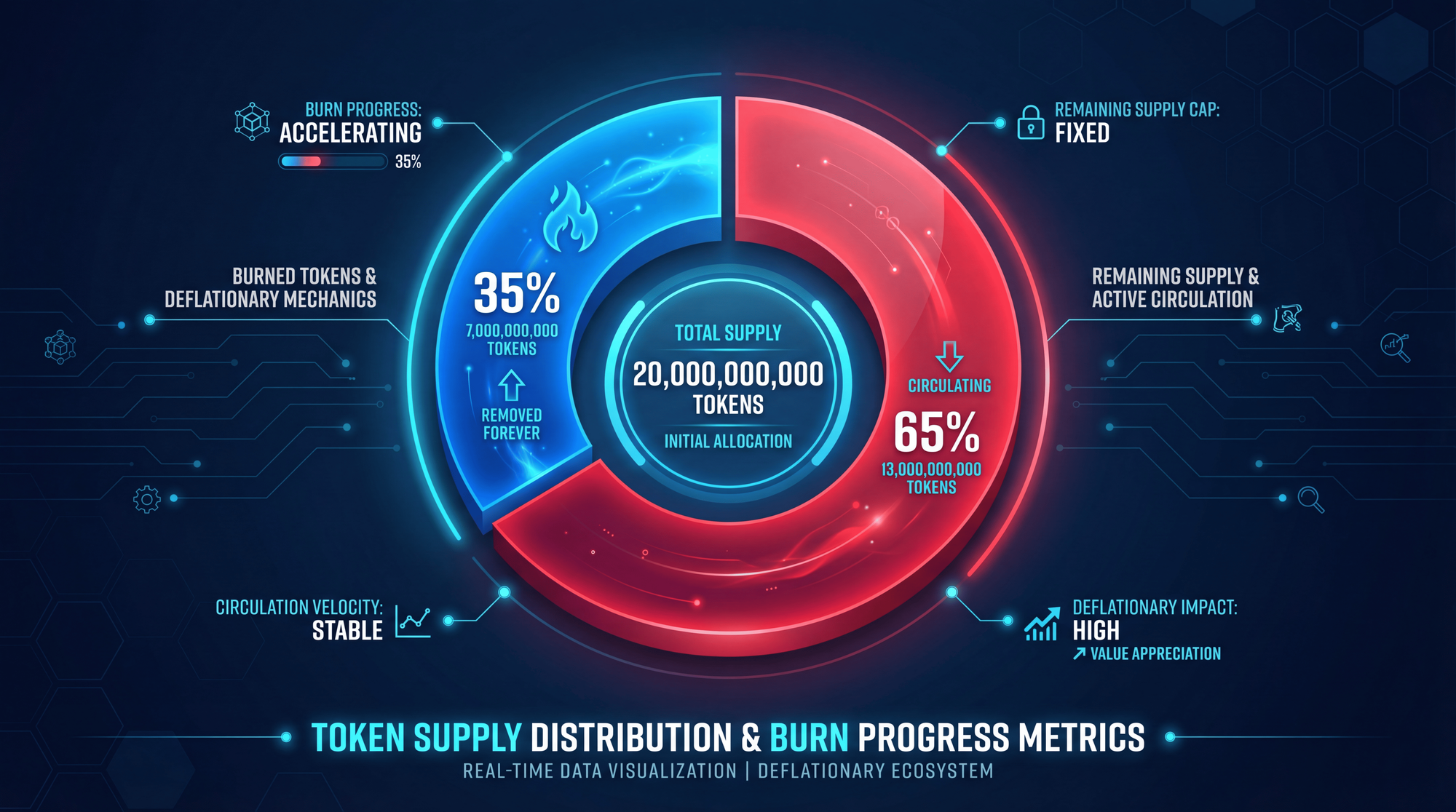

LUNC Tokenomics & Burn Mechanism

Understanding LUNC's tokenomics is crucial for evaluating its investment potential. Store your crypto securely in a proper cryptocurrency wallet before making any purchases.

🔢 LUNC Tokenomics (January 2026)

Total Supply

6.47 Trillion

Circulating Supply

5.47 Trillion

Market Cap

~$235 Million

All-Time High

$119.18

Total Burned

436.6 Billion

% Supply Burned

~6.7%

How the LUNC Burn Works

The Terra Classic community implemented a 0.5% transaction tax that automatically burns LUNC tokens. Here's how it works:

On-Chain Burns (19% of total):

- Every on-chain transaction is taxed 0.5%

- Taxed tokens are sent to a burn address and destroyed

- This includes transfers, staking, and smart contract interactions

Burn Wallet Donations (81% of total):

- Binance burns trading fees monthly

- Terraform Labs burned 249B tokens

- Community voluntary donations

Burn Statistics (January 2026):

| Source | Amount Burned | % of Total |

|---|---|---|

| Terraform Labs | ~249 billion | 60.7% |

| Binance | ~73 billion | 17.8% |

| On-Chain Tax | ~84 billion | 19.4% |

| Other Sources | ~9 billion | 2.1% |

| Total | 436.6 billion | 100% |

The Burn Math Problem

Here's the uncomfortable truth about LUNC burns:

📊 Burn Reality Check

- Current daily burn: ~48-139 million LUNC

- Tokens remaining: ~5.47 trillion

- Pre-collapse supply: 343 million

- Time to reach pre-collapse supply at current rate: 300+ years

Even with Binance's massive January 1, 2026 burn of 5.33 billion LUNC, the math remains brutal. To reduce supply by 90% would take decades at current burn rates - and that assumes burn activity continues indefinitely.

Binance Dependency Risk

⚠ Single-Point Failure Risk

Binance accounts for approximately 60%+ of all LUNC trading volume and burns. The exchange recently reduced its burn commitment from 100% to 50% of trading fees. If Binance further reduces burns or delists LUNC, the project would face catastrophic consequences. This single-exchange dependency creates significant risk that most LUNC holders overlook.

LUNC Price History & Analysis

Historical Performance

LUNC's price history tells a tale of two extremes:

Pre-Collapse (2019-2022):

- Launch Price (2019): ~$0.20

- Bull Run Peak: $119.18 (April 5, 2022)

- Peak Market Cap: $41+ billion

- Rank: Top 10 cryptocurrency

Post-Collapse (2022-Present):

- All-Time Low: $0.000000999967 (May 13, 2022)

- Recovery Peak: ~$0.0006 (September 2022)

- Current Price: ~$0.000042-0.000045 (January 2026)

- Current Rank: #256-262

January 2026 Price Rally

The year started with unexpected bullish momentum:

📈 January 2026 Rally

- Trigger: Binance burned 5.33 billion LUNC on January 1

- Price Spike: +20% within 24 hours

- Volume Surge: +620% (reached $110M daily)

- Peak Price: ~$0.000045

Price Predictions 2026-2030

⚠ Price Prediction Disclaimer

These predictions are speculative estimates based on current trends. Even the "bull case" scenarios represent prices 99.99% below LUNC's all-time high. Cryptocurrency markets are extremely volatile - never invest more than you can afford to lose.

Bullish vs Bearish Factors

📈 Bullish Factors

- Active Community: Terra Rebels continue development and governance

- Consistent Burns: 436+ billion tokens destroyed, ongoing monthly burns

- Exchange Support: Listed on Binance, KuCoin, Kraken, and major exchanges

- Network Upgrades: v3.6.1 improvements, Cosmos SDK integration

- Low Entry Price: Psychological appeal of owning millions of tokens cheaply

📉 Bearish Factors

- Massive Supply: 5.47 trillion tokens still circulating - burn impact minimal

- Damaged Reputation: Forever associated with $45B collapse and fraud

- Founder Imprisoned: Do Kwon's conviction reinforces negative narrative

- No Major DApps: Ecosystem never rebuilt to pre-collapse levels

- Binance Dependency: 60%+ reliance on single exchange for burns

- Declining Interest: Trading volume and developer activity decreasing

How to Buy Luna Classic (LUNC)

If you decide to purchase LUNC despite the risks, here's how to do it safely. Make sure you have secure Bitcoin wallets or multi-crypto wallets ready.

Choose a Reputable Exchange

LUNC is available on Binance (highest liquidity), KuCoin, Kraken, Gate.io, and MEXC. Binance is recommended for best prices and burn contribution.

Complete KYC Verification

Register an account and complete identity verification. Most exchanges require at least basic KYC for fiat deposits and withdrawals.

Deposit Funds

Deposit fiat (USD, EUR) via bank transfer or card, or transfer existing crypto (USDT, BTC, ETH) to your exchange wallet.

Buy LUNC

Search for LUNC/USDT or LUNC/BUSD pair. Use market order for instant purchase or limit order to set your target price.

Secure Your LUNC (Optional)

For long-term holding, transfer to a non-custodial wallet like Terra Station, Ledger, or Trust Wallet. Note: on-chain transfers incur the 0.5% burn tax.

💡 Pro Tip

Buy and hold LUNC on Binance if you want your trading fees to contribute to token burns. Binance burns a portion of all LUNC trading fees monthly.

Frequently Asked Questions

Is Luna Classic dead in 2026?

No, Luna Classic is not technically "dead." The blockchain continues to operate with 130+ active validators, transactions process normally, and the community remains engaged. However, LUNC's chances of returning to its former price levels are essentially zero. Consider it alive but permanently diminished - functional as a speculative asset, but unlikely to recover meaningful value.

What happened to Terra Luna?

In May 2022, Terra's algorithmic stablecoin UST lost its $1 peg, triggering a catastrophic "death spiral." The mechanism designed to stabilize UST instead caused LUNA's supply to explode from 343 million to 6.53 trillion tokens in just days. This hyperinflation crashed LUNA's price by 99.99999%, wiping out over $45 billion in market value. Founder Do Kwon was later arrested and sentenced to 15 years in prison for fraud.

Is LUNC the same as LUNA?

No. After the collapse, the original blockchain became "Terra Classic" (LUNC), while a new blockchain called "Terra 2.0" was launched with a new token simply called LUNA. LUNC has trillions of tokens in supply; LUNA 2.0 has approximately 1 billion. They are separate blockchains with different governance and purposes.

Does the LUNC burn actually work?

The burn mechanism has destroyed approximately 436.6 billion LUNC (6.7% of supply) since its implementation. However, with 5.47 trillion tokens remaining, the impact on price is minimal. At current burn rates of 48-139 million daily, it would take 300+ years to reduce supply to pre-collapse levels. The burn creates marginal deflationary pressure but cannot realistically restore LUNC's value.

Can LUNC reach $1?

This is essentially impossible. For LUNC to reach $1 would require a market cap of $5.47 trillion - larger than the entire cryptocurrency market combined and approaching the GDP of Japan. Even reaching $0.01 would require a $54.7 billion market cap. LUNC reaching its all-time high of $119 again would require a market cap larger than the global economy.

Can LUNC reach $0.01?

Reaching $0.01 would give LUNC a market cap of approximately $54.7 billion - roughly where it was at its peak in 2022. While theoretically not impossible, this would require unprecedented burn activity, massive new utility development, and complete market sentiment reversal. Most analysts consider $0.01 extremely unlikely within the foreseeable future.

Is LUNC worth buying in 2026?

LUNC should only be considered by those who:

- Can afford to lose 100% of their investment

- Understand they're essentially buying a lottery ticket with very poor odds

- Are attracted to the speculative "moonshot" potential

- Have already invested in more stable assets

Never invest money you need in LUNC. If you choose to speculate, limit your exposure to a small percentage of your portfolio (1-5% maximum).

Is LUNC a good investment?

LUNC is not an "investment" in the traditional sense - it's speculation. There are no fundamentals supporting significant price appreciation. The project has no unique technology, no major applications, and its founder is imprisoned for fraud. However, some traders profit from short-term volatility. Treat any LUNC purchase as gambling, not investing.

How much LUNC has been burned?

As of January 2026, approximately 436.6 billion LUNC tokens have been burned (~6.7% of the original hyperinflated supply). The largest contributor is Terraform Labs (249B), followed by Binance (73B), and on-chain transaction taxes (84B). Binance burned 5.33 billion LUNC on January 1, 2026, alone.

What is USTC?

USTC (TerraClassicUSD) is the renamed version of the original UST stablecoin that caused the Terra collapse. It no longer maintains any peg to the US dollar and currently trades around $0.01-0.02 - a 98-99% loss from its intended $1 value. Some community members hope to eventually re-peg USTC, but this remains highly unlikely.

Key Takeaways

🎯 Key Takeaways

- LUNC is the remnant of the original Terra blockchain after the catastrophic May 2022 collapse

- Price is down 99.99% from ATH of $119.18, currently trading around $0.000042-0.000045

- 436.6 billion tokens burned (6.7% of supply), but 5.47 trillion remain

- Do Kwon sentenced to 15 years in US prison (December 2025)

- Community-governed by Terra Rebels since Do Kwon abandoned the chain

- Reaching $1 is mathematically impossible - would require $5.47T market cap

- Only speculate with money you can afford to lose entirely

Ready to Explore Crypto?

Start your crypto journey with Zipmex - trade Bitcoin, Ethereum, and 100+ digital assets securely.

Create Free Account →📋 Investment Disclaimer

This article is for educational purposes only and does not constitute financial, investment, or trading advice. Cryptocurrency investments carry significant risk of loss. LUNC is an extremely high-risk speculative asset. Past performance does not guarantee future results. Always conduct your own research and consider consulting a qualified financial advisor before making any investment decisions. Never invest more than you can afford to lose.